Medigap Plan G is one of the most popular Medicare supplement plans available, second only to Plan F (which will be phased out in 2020). These two plans are very similar. However, the only difference is that Plan G does not cover Medicare Part B deductibles. However, all plans that cover Part B deductibles will be phased out in 2020. As such, Medigap Plan G is perhaps the best option if you want every possible expense covered.

However, it’s important to note that Plan G is one of the most expensive you can buy. If you do not need all of the coverages included in this plan, there are other options available to you. For example, if you do not travel abroad, a plan that includes foreign travel emergency coverage would not be necessary.

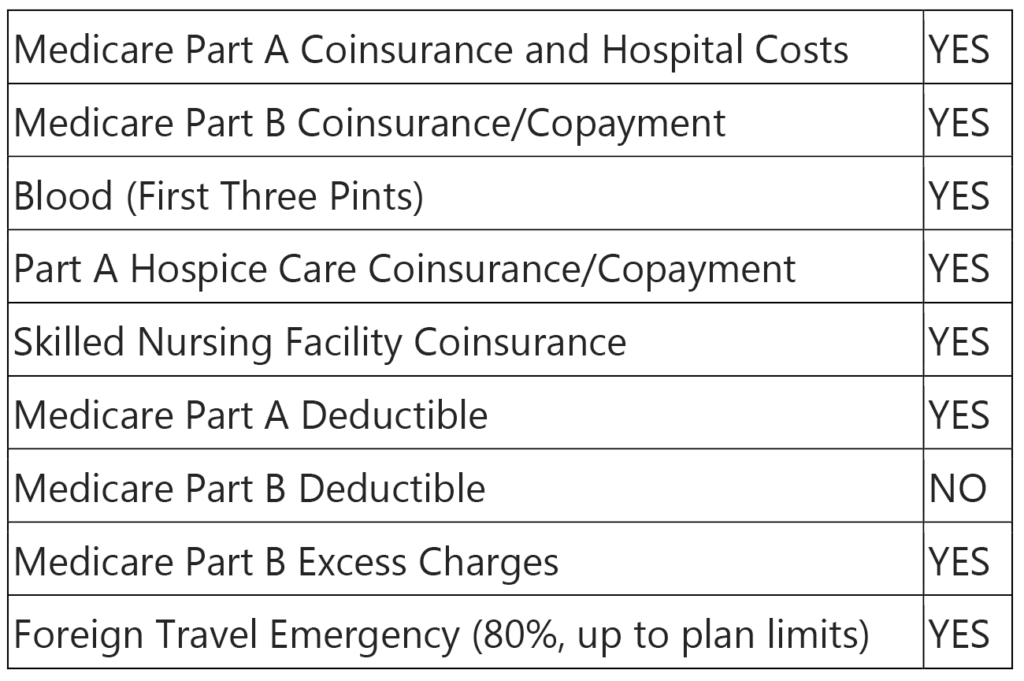

Coverages included in Plan G include:

Many people find it less expensive to buy a Plan G plan and cover the Medicare Part B deductible out-of-pocket. In 2019, this deductible is $185. It will increase in 2020, and if past increases are any indication, it will only increase by a few dollars at most. The cost difference between Medigap Plan F and Plan G may be greater than this deductible. If it is, it would be more cost-efficient to purchase Plan G instead of Plan F.

How Much Does Medigap Plan G Cost?

Your Medigap Plan G cost will largely depend on your age, sex, tobacco usage, and ZIP code. In addition, you may receive a household discount if you and your spouse or another member of your household buy a Medigap plan from the same insurance provider. Without knowing your full story, we cannot say for certain how much Medigap Plan G coverage will cost. However, we can help you shop around with different providers to find the best option for you.

The good news is, the coverages provided by Medigap Plan G are standardized. This means, for instance, that a Medigap Plan G policy from United Healthcare that’s $100 less than a Medigap Plan G policy from Aetna will offer the exact same coverages. We can help you find the right company to buy a plan based on companies’ premiums, historical premium increases, and the financial stability of different providers.

Enrolling in Medigap Plan G

On the first day of your birth month in which you are both 65 or older and enrolled in Medicare Part B, a six-month Medigap Open Enrollment period begins. During this period, you can easily enroll in Medigap Plan G. Insurance providers are forbidden from asking you questions about your medical history, and they are not allowed to deny you coverage. This is the ideal time to enroll in a Medigap Insurance plan.

This open enrollment period will only happen one time for most people. If you do not enroll in Medigap during this period, you may still apply to get supplemental insurance. However, providers may now ask you questions about your medical history. In addition, they may deny you coverage or set higher premiums for your policy.

This Medigap Open Enrollment period is not the same as Annual Open Enrollment period for Medicare. Various parts of Medicare have open enrollment periods throughout the year, the most well-known being the open enrollment period in the fall. This period allows people to change their enrollment status in Medicare Part D and/or their Medicare Advantage plan. The open enrollment period for Medigap, however, only occurs once.

Do I Need a Medigap Policy?

Medicare supplemental insurance is completely optional. It was created shortly after Medicare came into effect to offset many of the expenses left behind after Medicare paid its part. By having a Medigap insurance policy, older Americans can more easily get the medical treatment they need without worrying about the copays, deductibles and other costs that Medicare only pays a part of.

As of 2019, there are 10 different Medigap plans, and each one provides a different level of coverage. As such, each one is sold at a different price point. After 2019, Plan G will be the most comprehensive option, but will also be the most expensive. Other options, like Plan B, do not offer as many coverages but are also not as expensive. For some, the Medigap Plan G cost simply isn’t worth it. Instead, paying a few deductibles or copays out-of-pocket makes much more financial sense.

It’s important to evaluate all of your options during your Medigap Open Enrollment period to make sure you choose the Medicare Supplemental Insurance (Medigap) policy that best fits your needs. With so many options, from different plans to different companies selling Medigap, finding the right solution can be difficult. Our expert insurance brokers are here to help. Give us a call today at (678) 807-8414 or contact us online to learn more about Protecting What’s Ahead!