Medigap Plan K is becoming a popular Medicare supplement policy among older Americans. While it completely covers Medicare Part A coinsurance and hospital costs, it only partially covers the other gaps in Medicare treatment. Many people are finding that sharing these costs is less expensive than buying more comprehensive Medigap plans. These plans are something of a “middle ground” between the fully comprehensive plan and a more barebones plan.

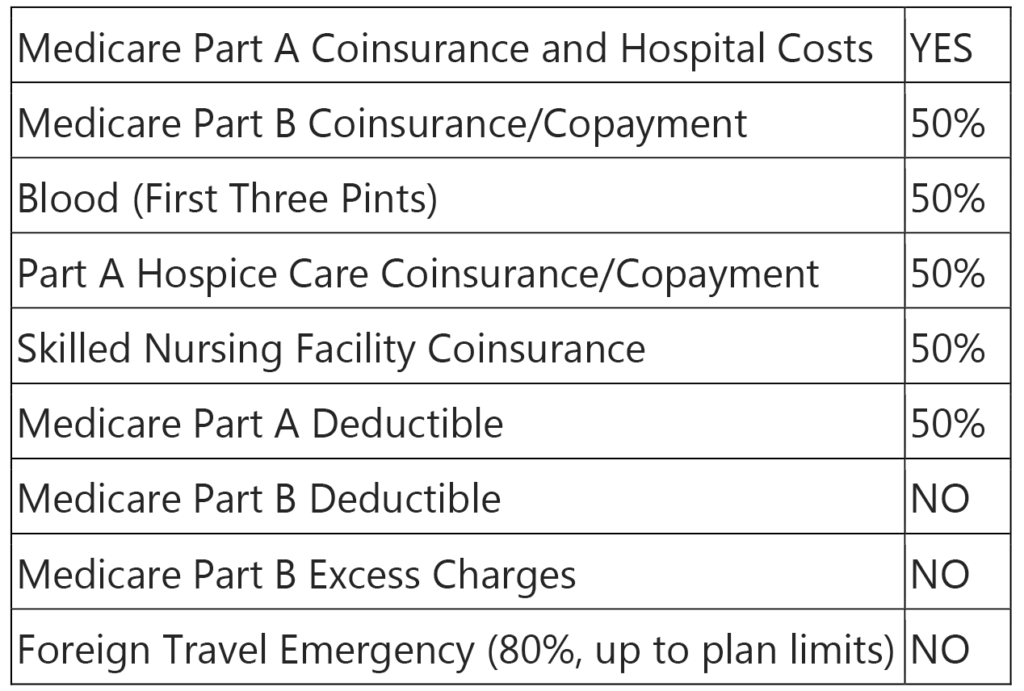

Coverages provided by Medigap Plan K include:

In addition to these coverages, there is an out-of-pocket cap associated with this Medigap plan. In 2019, the Medigap Plan K out-of-pocket maximum is $5,560. Once you have reached this limit, all additional Medicare-related medical expenses are 100% covered by your Medigap Plan K policy. This can be a great benefit for those who may not visit the hospital for one year but are then in the hospital a lot the next.

Though there are fewer benefits, the premiums for Medigap Plan K are generally lower than premiums for other policies. While this plan does still cover preventative care services, you will be responsible for deductibles and part of the copayments for Medicare Part B, such as for outpatient treatments.

How Much Does Medigap Plan K Cost?

There are a few factors that impact the cost of every Medicare supplement plan, including Medigap Plan K. These factors include your sex, age, ZIP code, and tobacco usage. When you enroll in Medigap can also be a factor. If you and your spouse or another member of your household purchase Medigap coverage from the same insurance provider, that provider may offer a discount.

It’s important to note that Medigap Plan K is not provided by every insurance company. As such, finding a policy can be difficult. However, when insurance providers do offer this plan, it is standardized, meaning all companies must offer the same coverages, though they don’t have to do so at the same price.

You are free to shop around with different insurance companies to find the right provider for you. There are a few factors you should consider when you’re looking for a Medigap Plan K provider. First and foremost, consider the premiums for plans from each company. Then, evaluate the increases in premiums for the past few years to see if these increases are reasonable. Finally, look at the financial stability of each insurance provider you’re considering.

This information can be difficult to find. Even finding honest premiums can be complicated. Our experienced insurance brokers can help you research different Medigap plans and providers to find the right plan for you.

Do I Need a Medigap Plan?

When Medicare was passed in 1965, it was intended to cover the bulk of the medical costs for people unable to work (namely, older Americans and disabled citizens). However, this government program only covers part of the medical expenses you may incur. Medigap plans were created just after Medicare was passed to cover these “leftover” expenses.

Medicare supplement plans are by no means mandatory. However, if you don’t want to worry about many of the copays, deductibles and other costs not covered by Medicare, you should consider one of the 10 Medigap plans. Some of these plans, like Plan G, cover virtually every cost but are more expensive. Others, like Plan A, are less expensive, but provide fewer benefits. Medicare Advantage can also be a good option for many people, depending on your needs.

Enrolling in Medigap Plan K

On the first day of your birth month in which you are both 65 or older and enrolled in Medicare Part B, a six-month window opens for you to enroll in a Medigap insurance policy. This is a one-time only window for most people, and once it’s gone, it’s gone. During this Medigap Open Enrollment period, insurance providers may not ask you questions about your medical history, nor can they deny you coverage.

You can still apply for Medigap coverage after this open enrollment period has passed. But, insurance providers are well within their rights to inquire about your medical history. They can also deny you coverage or increase the price of your premiums as they see fit. With this in mind, it is always best to enroll in Medigap Plan K during your Medigap Open Enrollment period.

Because finding a provider for Medigap Plan K can be difficult, and finding a policy at the right price can be even harder, we recommend that you contact one of our expert insurance brokers to help you in your search. Give us a call at (678) 807-8414 or contact us online to speak with one of our experts and learn more about Protecting What’s Ahead.