Medicare Part B provides medical insurance coverage to older adults in the U.S. as well as some qualifying individuals with disabilities, end-stage renal failure, or amyotrophic lateral sclerosis (ALS, or Lou Gherig’s disease). It covers a broad range of necessary health services provided in either an outpatient setting or as part of an inpatient stay in a hospital.

You can think of Medicare Part B coverage as the “doctor’s insurance” counterpart to Medicare Part A’s “hospital insurance.” Together, Part A and Part B are intended to address a majority of medical emergencies or ongoing health needs as components of the “Original Medicare” services.

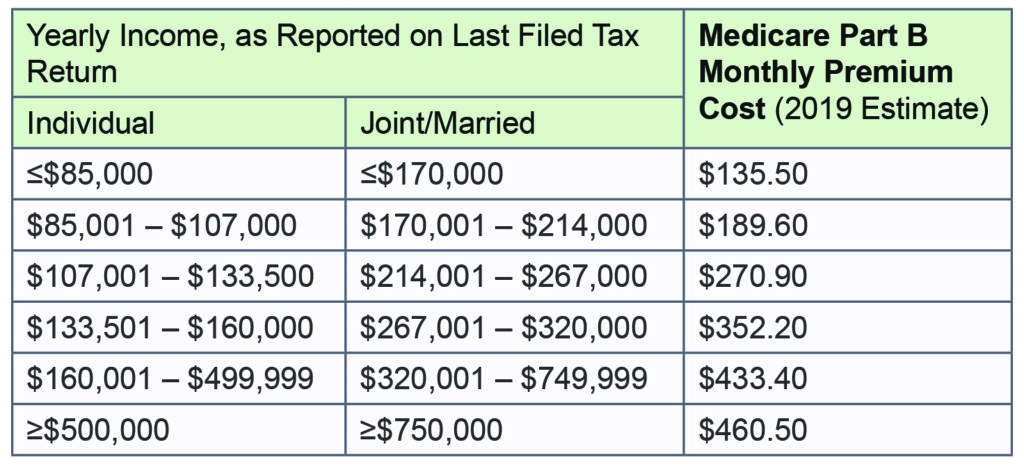

The cost of Medicare Part B will vary according to your income. You may also pay a late penalty as part of your Medicare Part B premium if you happened to sign up outside of the standard Medicare enrollment period.

What Does Medicare Part B Cover?

Generally speaking, Medicare Part B covers two main categories of medical treatment. The Medicare.gov website defines these coverage categories as follows:

- Medically necessary services: treatments, doctor’s services, and medical supplies that meet the accepted standards of medical practice and that are necessary for the diagnosis or treatment of known or suspected medical conditions

- Preventative services: doctor’s services and treatments needed to prevent health conditions, reduce their likelihood of progressing, or detect them in their early stages

Looking at more specific types of medical services Medicare Part B covers, your policy can include:

- Doctor’s visits

- Surgeries and outpatient procedures

- Emergency room services and treatment

- Necessary inpatient services or supplies not covered by Part A

- Ambulance transport

- Durable medical equipment (DME), like hospice beds

- Mental health services, including inpatient, outpatient, and partial coverage for mental health-related hospitalizations

- Getting a second opinion from a medical doctor prior to surgery

- Certain qualifying outpatient prescription drugs

Of note is the fact that Medicare Part D provides very little in the way of coverage for prescriptions. If you wish to have a broader range of prescriptions covered, you can research your options for a Medicare Part D plan.

The Cost of Medicare Part B

The cost of Medicare Part B includes three components: your Medicare Part B premium, a yearly deductible, and a coinsurance cost share that is included in most covered services.

Medicare Part B Premium

Your Medicare Part B monthly premium will vary according to your yearly income, as defined on your yearly tax return. Most individuals will pay the Medicare Part B premium base cost, which is $135.50 per month.

Medicare Part B Deductible and Coinsurance

The Medicare Part B cost includes a low yearly deductible. You will need to cover the cost of this deductible before you can receive coverage for any services or supplies you obtain. Fortunately, once this deductible is paid, you will not have to pay it again until the start of your next yearly benefit period.

As of 2019, the annual Medicare Part B deductible is $185.

You will also pay a coinsurance cost for many covered services once your deductible is met. Medicare Part B coinsurance charges 20% of the Medicare-approved cost for:

- The majority of doctor’s services, both inpatient and outpatient

- Outpatient physical therapy and rehabilitative services

- Durable medical equipment (DME)

How to Sign up for Medicare Part B

Most people do not have to apply for Medicare Part B if they are already eligible for Social Security benefits and are approaching their 65th birthday. Instead, they will be automatically enrolled in Medicare Part A and likely Part B in the three month period before they turn 65.

Similarly, you will be automatically enrolled in Medicare Part B if you have been receiving Social Security benefits for a qualifying disability for at least 24 months (two years).

You should receive a notice in the mail that you qualify for Medicare Part B if either of these two scenarios applies to you. The Centers for Medicare Services will send you your red, white and blue Medicare card through the mail about three months before your 65th birthday or just after your 24th month of receiving Social Security disability benefits.

Do I Have to Sign up for Medicare Part B If I’m Not Automatically Enrolled?

In some instances, you may not automatically be enrolled in Medicare Part B. The most common scenario is that you are not going to receive Social Security or Railroad Retirement Board benefits at least 4 months before you turn 65 years old.

You may also have end-stage renal disease or ALS, which likely means that you will not be automatically enrolled.

If this is the case, you do have to apply to Part B manually. Note that you must be enrolled in Medicare Part A to be eligible for Part B coverage.

You can sign up for Medicare Part B using any of the following methods:

- Use the online Medicare Part B application on the Social Security website

- Call the Medicare Part B phone number at 1-800-772-1213 (TTY: 1-800-325-0778)

- Print out the Medicare Part B forms manually and return them to your local Social Security office

- Visit your local Social Security office for the proper Medicare Part B forms and assistance

- Contact an insurance broker for assistance applying to Medicare Part B, determining eligibility, and evaluating possible supplemental coverage or Medicare Advantage plans

Medicare Part B Standard Enrollment Period

The best time to sign up for Medicare Part A and Part B is during the standard 7 month enrollment period. This period encompasses the three months before your 65th birthday, the month you turn 65, and the three months after.

Medicare.gov recommends that you sign up in the period three months before your 65th birthday. Otherwise, you will likely have a gap in coverage.

Medicare Part B Special Enrollment Period

You can elect to delay receiving Medicare Part B coverage without a penalty if you or your spouse continue working and are covered under a group health plan through your employer or union.

The time you are working constitutes a “Special Enrollment Period” (SEP) for Medicare Part B. You can sign up for Part B at any time during this period. Your SEP also has an additional eight months starting the month after you are no longer employed or when coverage for your group health insurance plan ends.

Note: COBRA and retiree health plans aren’t qualifying employer-based group health insurance plan coverage. If you have either of these forms of coverage, you will not be eligible for a special enrollment period.

Avoiding the Medicare Part B Penalty

If you do not sign up for Medicare Part B during the initial 7-month enrollment period surrounding your 65th birthday or during a special enrollment period available to you, you can sign up during the general enrollment period between January 1 and March 31 of each calendar year.

However, you will likely have to pay a penalty on top of your monthly Part B premiums.

The Medicare Part B penalty adds on 10% of your monthly premium cost for every 12 months you were not covered. This penalty likely exists to discourage individuals from foregoing Part B coverage until they are already sick and need it, which would raise coverage costs.

Your Medicare Part B penalty lasts until the end of your life. Accordingly, do not forego this coverage without serious consideration and/or discussion with a tax, accounting, or health insurance professional.

Is Medicare Part B Optional?

Yes, Medicare Part B is optional. Medicare Part A is required in order to receive retirement benefits from Social Security or the Railroad Retirement Benefit (RRB) board.

However, opting to not receive Medicare Part B coverage during your initial enrollment period and then signing up for it later will cause you to incur a penalty fee that adds to the cost of your monthly premiums.

Additionally, you need to be enrolled in both Medicare Part A and Part B in order to qualify for a replacement plan under Medicare Part C, also known as the Medicare Advantage plans. You will also need to be enrolled in Parts A and B to qualify for Medigap plans.

Since Medicare Part A only covers the cost of inpatient services during certain hospital stays, enrolling in Medicare Part B is highly advisable for the average person, although exceptions can certainly apply under unusual circumstances.

Georgia Medicare Part B Claims and Fee Schedule Amounts

Healthcare providers are reimbursed for their services according to the Medicare fee schedule. This document lists the corresponding fees each doctor, provider, or supplier is entitled to based on negotiated rates. It varies according to the year and according to the locality, as determined by the ZIP code of the corresponding business location.

The current fee schedule can be accessed on the Centers for Medicare & Medicaid Services (CMS) website.

Need Assistance Applying for Part B or Making Related Decisions in Georgia?

Despite the government’s best efforts, applying to Medicare Part B and determining what is covered can be quite confusing.

Often, it can be beneficial to talk to an insurance professional who can provide assistance and help explain your different options. You can also receive advice and guidance for the optimal Medicare coverage in Georgia for your given health factors and personal preferences.

To speak to an experienced health insurance professional who can assist you with completing your Medicare Part B application and making decisions, contact us today by calling (678) 807-8414. We pledge to keep you informed of your best options and help you Protect What’s Ahead.