Medigap Plan B is one of the 10 Medigap plans offered by private insurers. It is similar to Medigap Plan A but offers more coverage. As such, it is generally more expensive than Plan A. However, for some people, this extra coverage may be well worth the cost. It’s important to speak with an expert insurance broker here at MMIG about all of your Medigap options.

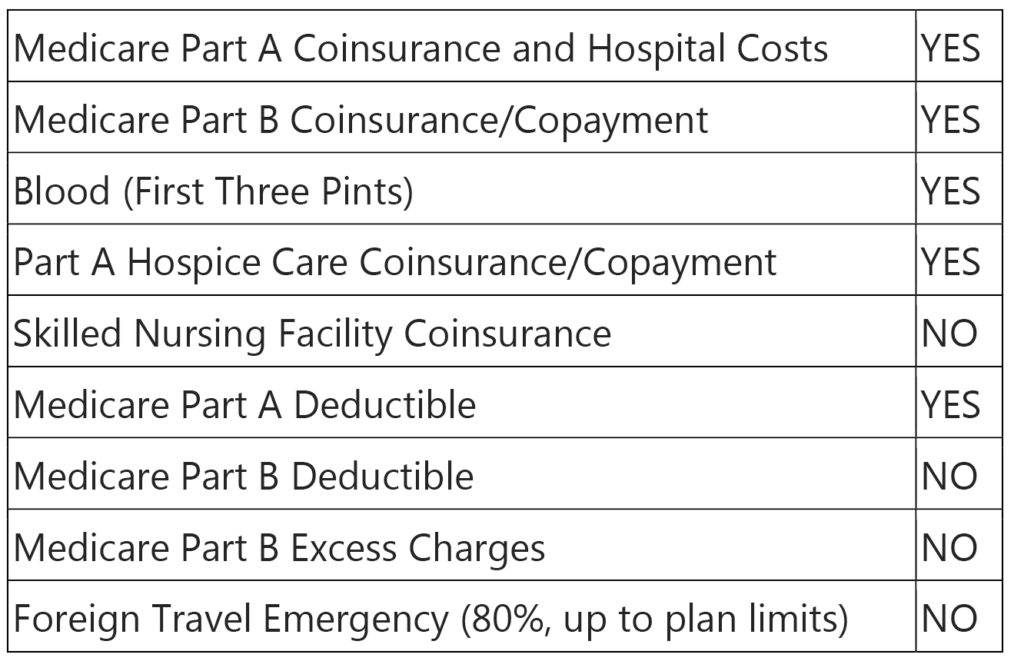

Medigap Plan B coverage includes:

As you can see, the main difference between Plan A and Plan B is that Plan B covers your Medicare Part A deductible. This means Plan B will cover your hospital deductible for you. In 2019, the Medicare Part A deductible is $1,364 a year, and will only increase. Having this deductible covered by Medigap Plan B could save you a lot of money annually.

How Much Does Medigap Plan B Cost?

As with every Medigap plan, the cost of coverage will depend on a few different factors, such as your sex, age, tobacco usage, and ZIP code can affect your rate. In addition, some insurance companies offer discounts for households who buy multiple plans. Since a Medigap plan will only cover one person, it’s not uncommon for households to buy multiple plans — one for each spouse and other potential dependents.

Remember that coverage provided under Medigap Plan B is standardized. As such, it’s important to shop around and evaluate the premiums set by different insurance companies. Look for the lowest rates offered by companies that don’t drastically increase their premium rates every year and are financially stable. An expert insurance broker at MMIG can help you evaluate all of your different options to choose the right plan for you.

How Medigap Plans Work

Shortly after Medicare was passed in 1965, private insurance companies began offering supplemental plans. These plans are designed to cover some or all of the medical costs that Medicare doesn’t. Typically, Medicare plans cover 80 percent of your costs, depending on the Parts you are enrolled in. Medigap plans cover the remaining amount.

In some cases, Medigap plans like A or B, which offer only a few coverages, are enough. For example, if you aren’t worried about the costs of hospital visits because you have a private nurse, you may not need a plan that covers Part A deductibles. There are 10 different plans you can choose from. It’s important to evaluate all of them to choose the right one.

It’s also important to note that Medigap Plan B is NOT the same as Medicare Part B. Medicare Part B covers your outpatient medical coverage, and is administered by the Centers for Medicare & Medicaid Services (CMS). Medigap Plan B, on the other hand, provides extra gap health insurance coverage not covered by Original Medicare Parts A & B.

When Can I Enroll in Medigap Plan B?

The best time to enroll in a Medigap Plan is during your Medicare Supplement Open Enrollment Period which lasts for 6 months and begins on the first day of month in which you are both 65 or older and enrolled in Medicare Part B. During this time, you will have the option to buy a Medigap plan. Insurers will not be allowed to ask you medical questions, and they cannot deny you coverage. In most cases, this open enrollment period is a one-time event.

After your Medicare Supplement Open Enrollment period has closed, you can still apply for Medigap coverage. However, insurance companies will have the right to ask you medical questions, and either deny your coverage or increase your premiums based on your medical history. So while you can technically apply to enroll in Medigap at any time, your best option is to enroll during your open enrollment period.

It’s important to note that this open enrollment period is not the same as the Medicare Annual Open Enrollment Period. While the Medicare Annual Open Enrollment period happens every year in the fall, the Medicare Supplement Open Enrollment period happens only once.

If you aren’t sure if Medigap part B is right for you or aren’t sure what insurance company to buy from, we can help. Give us a call at (678) 807-8414 or contact us online today. We’re here to help Protect What’s Ahead!