How much does Medicare cost? The total Medicare cost you will pay varies according to dozens of different factors. The most relevant factors related to the plans you have chosen, the coverage they offer, your deductible, your cost-share, and the number of treatments, supplies, and drugs you procure overall.

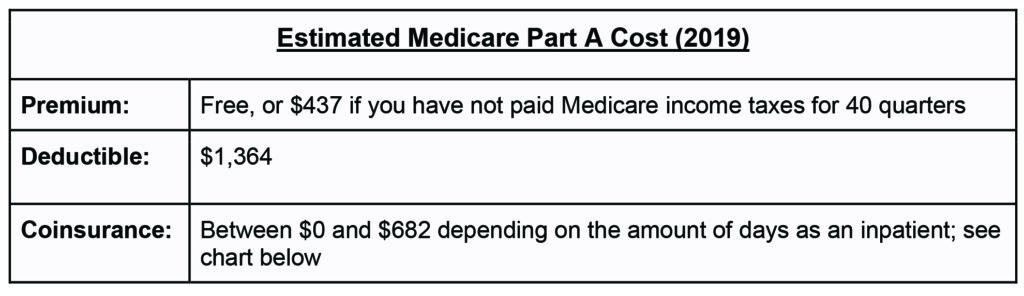

Nearly all Medicare components carry a monthly premium. The main exception is Medicare Part A; if you have paid income taxes on Medicare for at least 10 years (40 quarters) at a job or through self-employment, then you will not pay a monthly premium for your Part A hospital coverage. However, you will pay a cost-share in the form of coinsurance as well as possible copays.

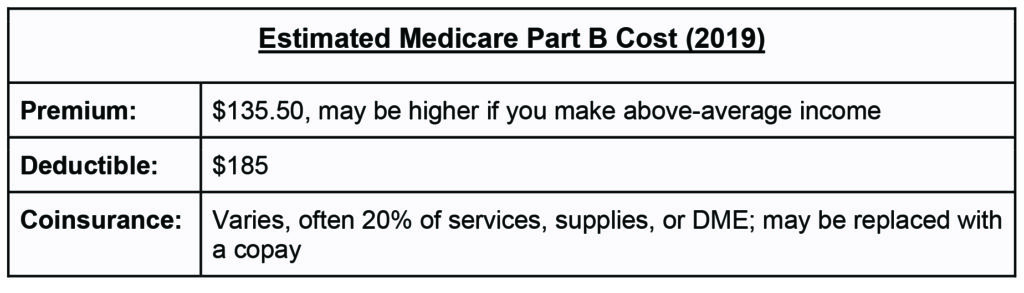

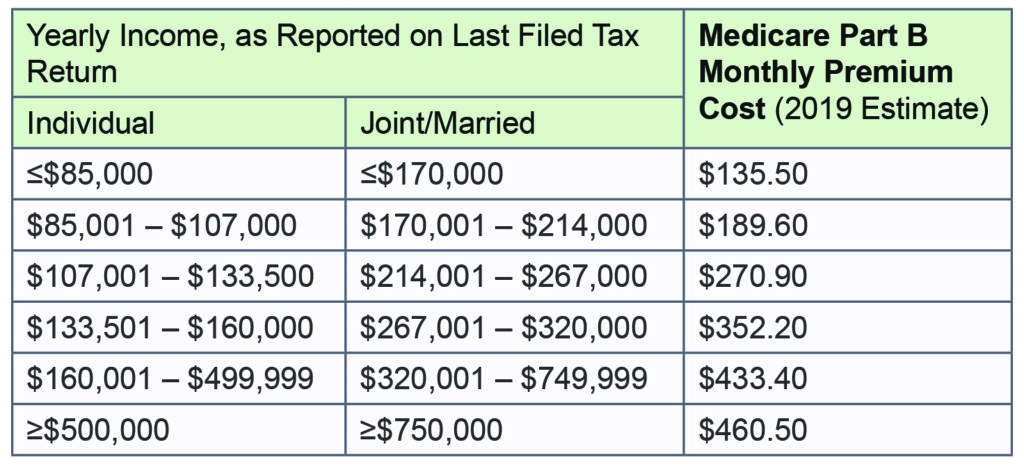

The cost of Medicare Part B is largely set. It includes a fixed monthly premium, which only changes if you make above a fairly large income threshold. Like Medicare Part A, Part B requires cost-sharing, including co-pays or coinsurance, depending on the service or medical supply rendered.

Medicare Part C and Part D costs can vary greatly depending on the specific plan selected. Note that you must also pay Part B premiums if you wish to enroll in a Part C plan.

Medigap plans have similar costs in the form of a monthly premium as well as possible copays and coinsurance. However, many Medigap plans aim to reduce the cost-sharing you pay through Part A and Part B.

Anyone concerned about their ability to pay for Medicare can seek assistance from the Centers for Medicare and Medicaid Services (CMS). Possible avenues for financial assistance include Medicaid, a Medicare Savings Program, and PACE plans.

Medicare Part A Cost

The good news about Medicare Part A is that most people will not have to pay a monthly premium.

To qualify for a $0 premium for Medicare Part A’s hospital insurance, you must have contributed to your Medicare taxes through your paycheck withholding or year-end tax bill for at least 40 quarters, equalling 10 years total.

Those who do not meet the 40 quarter work standard will pay a monthly premium, which equals $437 a month as of 2019. If you happened to have worked 30-39 quarters, you can qualify for the lower premium, which is $240 a month as of 2019.

The Medicare Part A deductible is $1,364 per benefit period as of 2019.

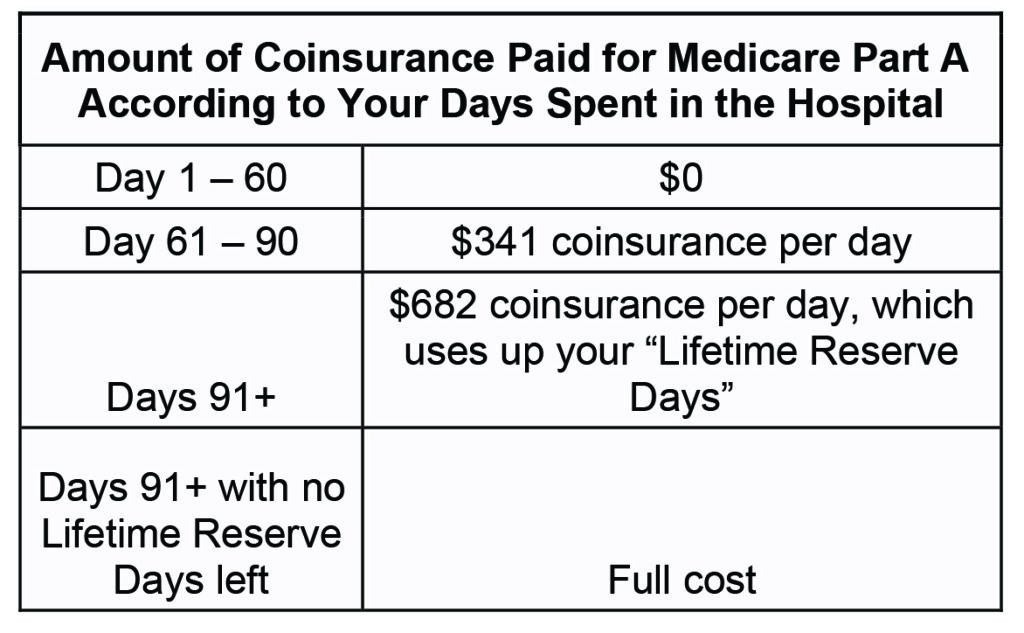

You will also have to pay a coinsurance amount depending on the number of days you stay as an inpatient in a covered hospital or skilled nursing facility.

Lifetime Reserve Days for Covered Medicare Part A Inpatient Costs

Your “lifetime reserve days” refers to the fact that you have 60 days total of reserves for which you do not have to pay the full cost of your inpatient stay across your lifetime.

These days begin counting once you reach past 90 days per benefit period as an inpatient. If you have zero of these days left, then you will pay the full cost of inpatient services for every day you spend in the hospital past 90 days per benefit period.

Fortunately, while your lifetime reserve days never reset, the start of a new benefit period means you can start counting your days spent as an inpatient over again from zero. This means you will have at least 60 days with no coinsurance cost and 90 covered days total per benefit period, even if you have used up all 60 of your lifetime reserve days in the past.

Medicare Part B Cost

Medicare Part B charges a standard premium. Everyone pays this same set premium, unless they make above a set threshold of income per year, in which case they pay a different premium amount according to their income bracket.

You may also pay higher premiums if you did not sign up for Medicare Part B during your initial enrollment period or special enrollment period. Signing up for Part B later incurs a roughly 10% penalty for every year you did not have coverage; this penalty lasts the entire time you are enrolled in Part B.

Medicare Part B also includes a deductible, although it is fairly low at $185 per year.

Your coinsurance for Medicare Part B is typically 20% of the cost of the doctor’s services, supplies, or durable medical equipment (DME) you have obtained. For many types of doctor’s visits, you may pay a flat copay instead of a coinsurance rate.

Medicare Part C Cost

Medicare Part C, also known as Medicare Advantage, refers to optional plans you can select from to replace your Medicare Part A, Part B, and often Part D drug coverage. Note that you must be enrolled in both Part A and Part B to qualify for a Part C plan. You also cannot have Part D if your Part C plan includes drug coverage.

Private insurers provide Medicare Part C plans, and these plans can vary dramatically in what they cover and their subsequent costs. Some plans can have low to $0 premiums but a high deductible and high-cost sharing. Others can have the opposite: a large premium but a high percentage of covered costs.

Review the details of any Medicare Part C plans you are considering carefully in order to determine their final cost. If you need assistance deciphering a plan’s cost scheme or selecting a plan that is right for you, you can contact a medical insurance professional for assistance.

Medicare Part D Cost

Medicare Part D refers to prescription drug coverage. Like Medicare Part C, there are many different Part D plans to choose from and many types of plans in general. These include plans with low to $0 premiums and a high deductible or cost-share, and it can also include plans that have a high premium but a large percentage of covered costs.

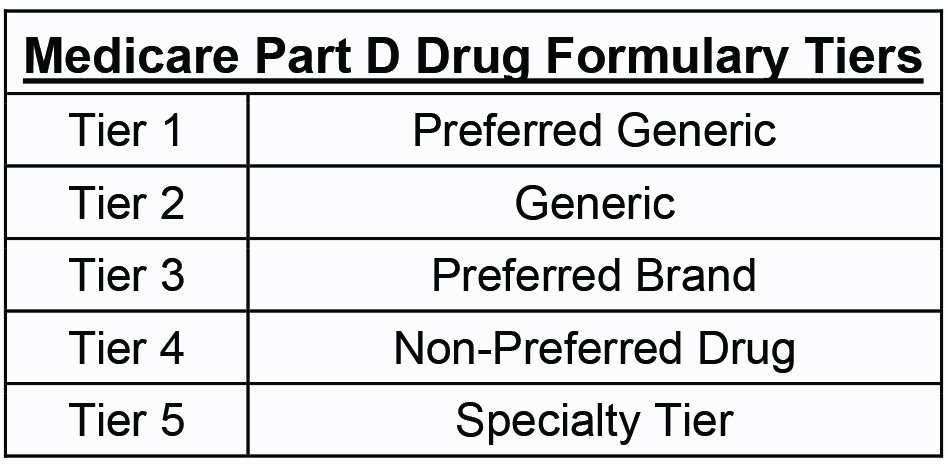

Medicare prescription drug coverage plans include a drug formulary, which outlines the costs you can expect to pay based on the type of drugs you get. The formulary is arranged into tiers.

If your drug is listed in the formulary, then you will pay a different cost share amount according to the formulary’s tier system as well as how much of the drug you will be purchasing at once, such as a 30 day supply or a 90 day supply.

You will also often be required to pay different copay amounts based on whether you order your drugs through a preferred retailer, a non-preferred retailer, or via mail order.

Medicare Part D Coverage Phases

Medicare Part D plans also include coverage phases. They correspond to the periods before you have met your deductible when your coverage activates when you have reached the cost limit for your benefit period, and when you have reached the out of pocket limit — respectively.

- Phase 1: Initial Deductible: You will pay 100% of your drug costs out of pocket until your deductible is met; in 2019, the deductible for the most part D plans was $415

- Phase 2: Initial Coverage Phase: Once your deductible is met, your Part D plan will cover the cost of drugs aside from a copay or a coinsurance cost

- Phase 3: Coverage Gap: Once your total drug costs have exceeded a set amount for the year, you will be required to pay a higher amount of coinsurance for both generics and brand names; some refer to this as the Medicare Part D “donut hole”

- Phase 4: Catastrophic Coverage Phase: Since most Medicare Part D plans have an out-of-pocket limit for the benefit period, your coverage will increase again, making your drug cost-sharing decrease

The “donut hole” some beneficiaries fall into during Phase 3 has, fortunately, been made less burdensome thanks to legislation passed in the wake of the Affordable Care Act. While before you could pay as much as 100% of the cost of your drugs during this period, you will now pay around 25% for Tier 3 brand name drugs, maximum, although generics may still cost more.

Medicare Supplement (Medigap) Plans

Medicare Supplement (Medigap) plans can be added to your coverage depending on the current plans you have selected. The goal of these plans is to lower your costs overall and have more things covered by your insurance.

There are over ten categories of Medigap plans, total, and some of them have different coverage options within them. Accordingly, the costs for a Medigap plan can vary greatly. Take a look at our Medigap Supplement Plans comparison for estimates and more information on selecting a plan.

Find Out How Much You Might Pay and What the Best Plan for You Might Be

We can help you estimate your Medicare costs and guide you towards a prescription drug plan, Advantage plan, and/or supplement plan that offers the most benefits to you at the lowest cost.

Call us at (678) 807-8414 or contact us online to get unbiased advice that can help you Protect What’s Ahead.