Medigap Plan D is one of the 10 Medigap plans available to those who qualify for Medicare. It covers many of the expenses you may incur due to medical treatment, but it doesn’t cover everything. This plan can be a good choice for those who don’t need additional coverage for the outpatient medical services that are mostly covered by Medicare Part B.

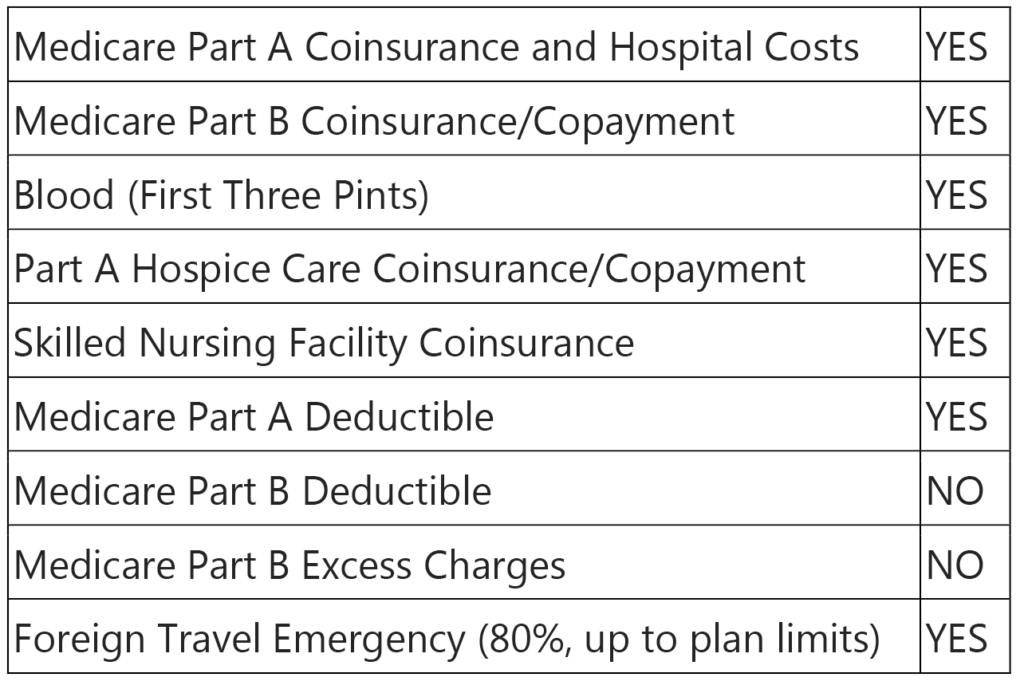

To answer the question “What is Medigap Plan D?”, we must look at the coverages provided by these plans:

Medigap Plan D provides every possible benefit besides Medicare Part B deductibles and Part B excess charges. If you do not require many outpatient and hospital services, Medigap Plan D can be an ideal choice. In 2019, the deductible for Medicare Part B is $185 (and will increase every year). If this is less than the increased price of a different plan with more coverages, then Plan D is a good choice.

It can also be a good choice if your doctor accepts Medicare. If they do, they accept the compensation they receive from Medicare as full payment for medical services rendered. However, if your doctor does not accept Medicare, they are allowed to set a price up to 15 percent more than the price allowed by Medicare. These are called Part B Excess Charges. If your doctor accepts Medicare, you don’t need to worry about having excess charges covered by your Medigap plan.

How Much Does Medigap Plan D Coverage Cost?

When you’re considering a Medigap plan, there are a few factors that will affect how much the plan will cost. This includes the coverages included in the plan, your age and sex, your tobacco usage and your ZIP code. In addition, if you and another member of your household both have Medigap plans from the same insurer, the insurer may offer a discount for the plans.

No matter who you buy Medigap Plan D coverage from, remember that these plans are standardized across the country. This means you will always get the same gap coverages from every insurance company. As such, you are free to shop around and find the right insurer based on premium rates, premium rate increases in recent years, the financial stability of the insurer, and other elements.

An experienced insurance broker at MMIG can help you find the right plan from the right insurance company.

Open Enrollment for Medigap Plan D

What time you enroll in Medigap Plan D can determine the cost of your insurance policy. Medigap Open Enrollment Period is the best time to enroll in a Medigap Part D plan. This period lasts six months and begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. This is a one-time open enrollment period to sign up for a Medigap plan. During this open enrollment period, the insurance companies cannot ask questions about your medical history, and they cannot deny you coverage.

If this enrollment period passes and you do not sign up for a Medigap plan, you can still apply for coverage with the insurance companies. However, they will now be allowed to ask you questions about your medical history, and deny you coverage or increase your premiums as they see fit. That’s why it’s important to apply for Medigap coverage during your Medigap open enrollment period.

It can be easy to confuse open enrollment for Medigap Plan D and open enrollment for Medicare Part D. Open enrollment for Medigap is a one-time event, except under specific situations. Open enrollment for Medicare, however, happens every year in the fall. During this period. You can change your enrollment status in Medicare Part D and/or your Medicare Advantage plan.

How Medigap Plan D Coverage Works

Though Medicare covers the majority of your medical costs, it will leave you with some deductibles, copays and other expenses. Medigap insurance was created by private insurers to cover some or all of these expenses so you don’t have to pay for them out of pocket. With Medigap, you can have peace knowing your medical costs are fully covered, even the gaps left behind by Medicare.

There are 10 different Medicare supplement plans, and each one offers different coverages. Some, like Plan G, cover every gap left by Medicare. Others, like Plan A, provide far fewer coverages. However, more comprehensive plans are more expensive than less comprehensive ones. Depending on your medical needs and other factors, a less comprehensive plan may make more sense than a more expensive plan.

You should also note that Medigap Plan D is NOT the same as Medicare Part D. Medicare Part D covers your retail prescription drug costs. Medigap Plan D, on the other hand, has nothing to do with prescription medicines.

All of this can be quite confusing, especially when it comes to choosing the right Medigap plan. But don’t worry, we can help! Give us a call at (678) 807-8414 or contact us online today to learn more about Protecting What’s Ahead.