Medigap Plan N is one of the newest types of Medicare supplemental insurance, introduced in 2010 under the Medicare Modernization Act. It is a rather comprehensive plan. The only expenses not covered are related to Medicare Part B, as you’ll see in the chart below. This insurance policy has become more popular in recent years, as people have accepted a small portion of cost-sharing in exchange for lower Medigap Plan N premiums.

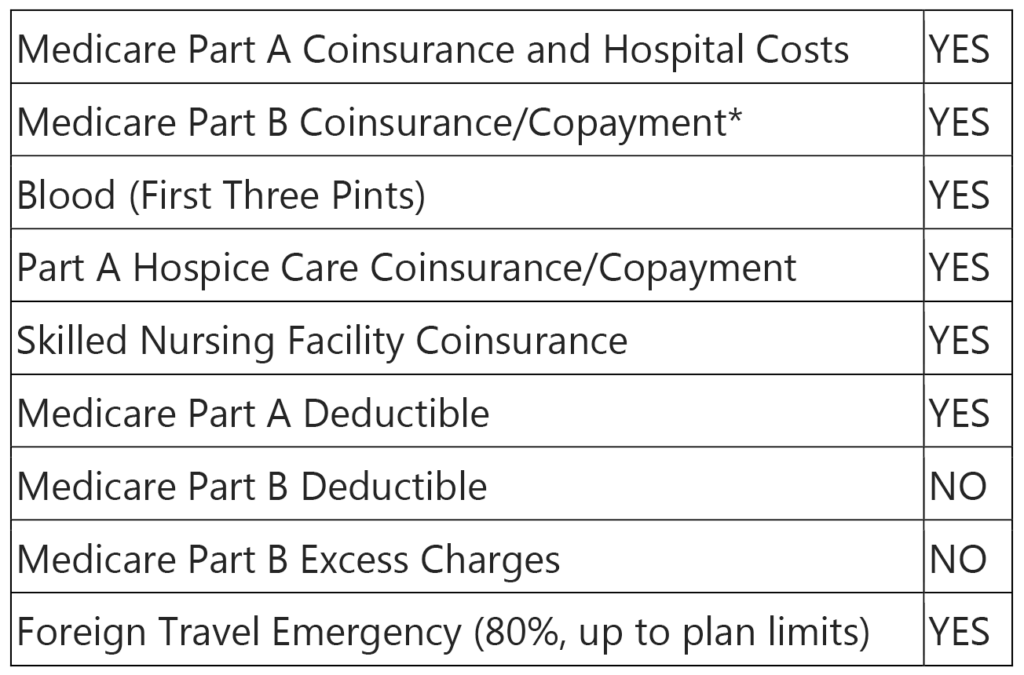

So what does Medigap Plan N cover? Here are the standardized coverages:

*Though Plan N will pay for your Part B coinsurance, you will still have copayments. These are relatively low: Up to $20 for doctor’s visits and up to $50 for emergency room visits. However, if your emergency room visit results in an inpatient admission, that $50 copay is waived.

Medigap Plan N is a great option for those who will be regularly visiting a hospital or doctor for treatment, and who have conditions that are likely to lead to medical emergencies. Though Plan N doesn’t cover your Medicare Part B deductible, no plan for people who enroll in Medigap in 2020 will cover this expense. Medigap Plan C and Plan F are being phased out.

In addition, your Plan N Medigap policy will not cover any Part B excess charges. These occur if your medical provider does not accept Medicare. If they accept Medicare, they agree that the payment they receive from the government will cover all medical treatments. If they don’t, however, they are allowed to charge up to 15 percent above the approved Medicare amount. If your doctor accepts Medicare, you don’t need to worry about these charges.

How Much Does Medigap Plan N Cost?

It’s impossible for us to say how much a Plan N Medigap policy will cost without getting to know you first. Insurance companies will base your Medigap Plan N premiums on your age, sex, ZIP code, and tobacco usage. In some cases, you may be able to get a discount if you and another member of your household buy a policy from the same company.

The good news is, the coverages offered under Plan N are the same no matter where you buy from. For example, if you find a policy from BlueCross BlueShield of Georgia that costs $50 a month less than a policy from Cigna, they will both have the exact same benefits. Knowing this, you can shop around and find a policy that fits within your budget and offers the benefits you need.

Though your premium is an important factor when you’re choosing an insurance provider for your Medigap Plan N policy, it’s not the only one. You should also consider how much rates have increased for your policy over the past few years. This could give you a clue as to how much you may be paying for your policy in, say, 5 years.

The financial stability of the insurance provider is also an important factor. If the company is not stable, they may suddenly raise your rates next year. Or, they could declare bankruptcy, leaving you with no Medigap coverage at all. Luckily, virtually all major insurance providers are stable companies.

Figuring out a company’s stability and previous rate increases can be difficult, but we can help. Our professional insurance brokers can conduct the bulk of the required research on your behalf to help you find the right policy from the right company.

When Should I Enroll in Medigap Plan N?

One factor we did not mention before that can affect your Medigap premiums is when you enroll. The best time to do this is during your Medigap Open Enrollment period. This period lasts six months and begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. During your Medigap Open Enrollment, insurance companies cannot ask questions about your medical history, and they cannot deny you coverage.

This Medigap Open Enrollment period is a one-time event. Once it’s over, you can still try to enroll in Medicare Supplemental insurance policy. However, insurance companies can and will ask about your medical history. Based on your answers, they can increase your premiums for a policy, or they could deny you coverage altogether.

It’s important not to confuse Medigap Open Enrollment with Medicare Annual Enrollment periods. During Medicare Annual Enrollment periods, you can change your enrollment status with a Part D prescription plan or a Medicare Advance plan. These periods happen every year. Medigap Open Enrollment, however, happens just once except under very specific circumstances.

Do I Need Medigap Coverage?

Though Medicare will cover the majority of your medical costs, you will still be left with some deductibles, copays and other expenses. Without Medigap, you will have to cover these expenses out-of-pocket. Medigap gives you peace of mind that your expenses for Medicare-related treatments will be covered.

As of 2019, there are 10 Medicare options to choose from. Some are higher priced but comprehensive, such as Plan G and Plan N. Others cover the bare essentials, but are much less expensive, such as Plan A. The right plan solely depends on your needs and your budget.

If you aren’t sure how to find a plan or need help enrolling in Medicare or Medigap, we can help. Our experts are here to guide you through the process and Protect What’s Ahead by choosing the right insurance plan that has you covered. Call us at (678) 807-8414 or contact us online today.