As the name implies, Medigap High Deductible Plan F policies are a form of Plan F Medicare supplement insurance. However, in this plan, you pay for the early costs of Medicare treatment. After you have reached your deductible, Medigap Plan F High Deductible covers you the same way a regular Medigap Plan F would.

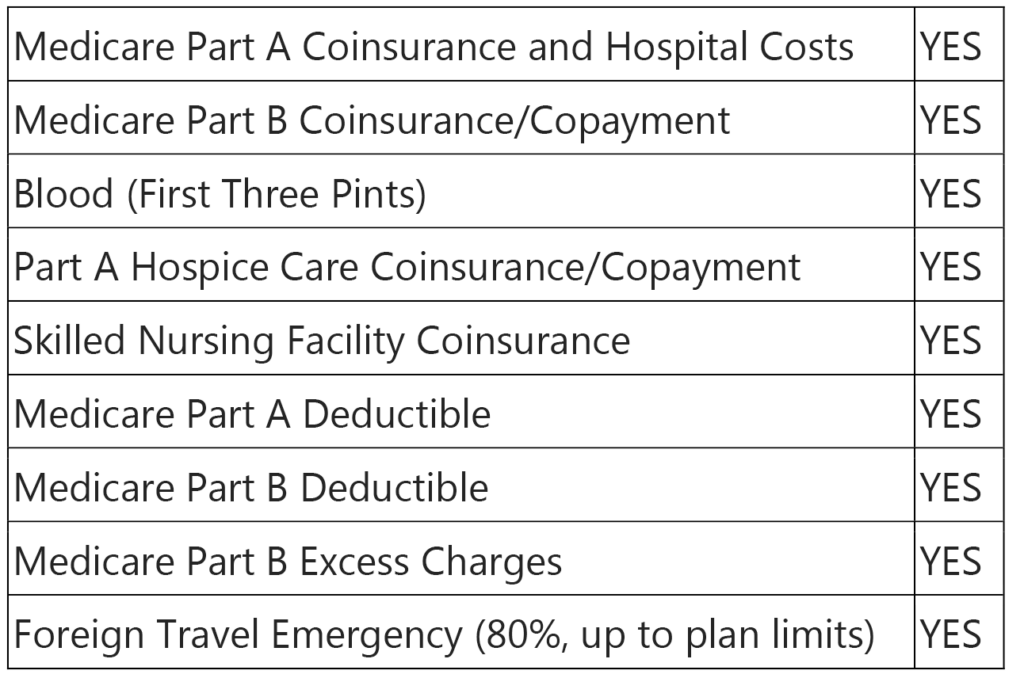

In 2019, the deductible for this plan is $2,300. Once you have reached this deductible, Medigap Plan F provides the following benefits:

This plan is popular with those who had a high-deductible plan or a health savings account when they were working since it maintains the status quo. Because this plan does have a high deductible, it is generally cheaper than a traditional Medigap Plan F policy. However, some people don’t want to have to worry about paying any copays, deductibles and other expenses at all, so they stick with the traditional Plan F.

If you have a significant retirement savings account and are generally healthy, Medigap Plan F High Deductible policies can save you a lot of money, since the premiums are much lower. However, many people who think they’ll be fine with the high deductible plan find it annoying to have to pay every time they go to the doctor or hospital until they reach their deductible.

If you’d rather have your money come out of your account monthly to pay for insurance rather than having to pay every time you need medical services, traditional Medigap Plan F may be the right option.

Medigap High Deductible Plan F is Being Phased Out

Anyone who qualifies for Medicare and Medigap coverage starting in 2020 may be in for a surprise: Medigap Plan F (including high deductible Plan F) and Plan C are being phased out. In short, any plans that cover the Medicare Part B deductible will no longer be available starting in 2020. If you are not enrolled by the start of the year, your next best options will be Medigap Plan G if you want most of the same benefits as Plan F, or Plan N if you don’t mind a bit of cost-sharing like you would find in the high-deductible plan F.

However, if you do qualify for Medigap during 2019, you can still buy a Medigap High Deductible Plan F policy. Unfortunately, it may be difficult to find a provider who offers this type of policy in Georgia, since it’s not a very popular one. But if you do find a few providers to choose from, it’s important to note that they are legally obligated to offer the exact same benefits, even if they do so at different prices.

To reiterate, if you qualify for Medicare before 2020, Medigap High Deductible Plan F is still available to you. In addition, if you have this plan or one of the others that are being phased out, you will still be covered. They will simply be unavailable to first-time customers in 2020.

How Much Does a Medigap Plan F High Deductible Policy Cost?

As with every Medicare Supplement (Medigap) plan, the cost of Medigap High Deductible Plan F will depend upon a few factors. These include your sex, age, tobacco usage, and ZIP code. If another member of your household already has a Medigap policy, you may both receive a discount if you also buy a policy from the same insurance provider.

Be sure to shop around and find the best plan for you. Your top factor will likely be the price of the premium, but that shouldn’t be your only criteria. You should also consider how much premiums from each provider tend to increase from year to year. It’s also important to consider how financially stable the provider is. You can typically tell how stable they are by how long they’ve been around and how well they’re respected in the community.

Of course, even if you do evaluate these factors, they don’t tell the whole story. Our insurance experts can help you evaluate all of your options, including Medigap policies from different companies, as well as other options like Medicare Advantage plans.

Enrolling in Medigap High Deductible Plan F

Though you can try to enroll in Medigap at any time after you’ve qualified for Medicare, your best bet is to enroll during your six-month Medigap Open Enrollment Period. This period begins when you turn 65 or older and are enrolled in Medicare Part B. During this period, insurance companies may not ask you any medical questions, and they may not deny you coverage. This is the time during which you will get the best prices.

After this six-month period has passed, you can still try to enroll in Medigap. However, insurance companies will be allowed to inquire about your medical history, and they can choose to deny you coverage. If they do sell you a policy, your premiums may be much higher than they would’ve been during your Medigap Open Enrollment.

Note that Medigap Open Enrollment only happens one time, except in very specific situations. This is different than Medicare enrollment periods, which happen throughout the year on an annual basis. If you miss your Medigap Open Enrollment period, it’s gone forever, and you may not ever be able to enroll in Medigap Supplement plans.

If you aren’t sure what Medigap plan is right for you, or you’re confused about the enrollment process, you’re not alone. Our experts are here to help you learn about all of your options for Protecting What’s Ahead. Call us at (678) 807-8414 or contact us online.