The first of the 10 Medigap plans is Plan A. Because it only offers a few benefits, the premiums for Medigap Plan A are typically pretty low. As such, it can be a great option for anyone who doesn’t need much gap coverage for whatever reason, whether they can afford copays or they don’t have any serious health problems.

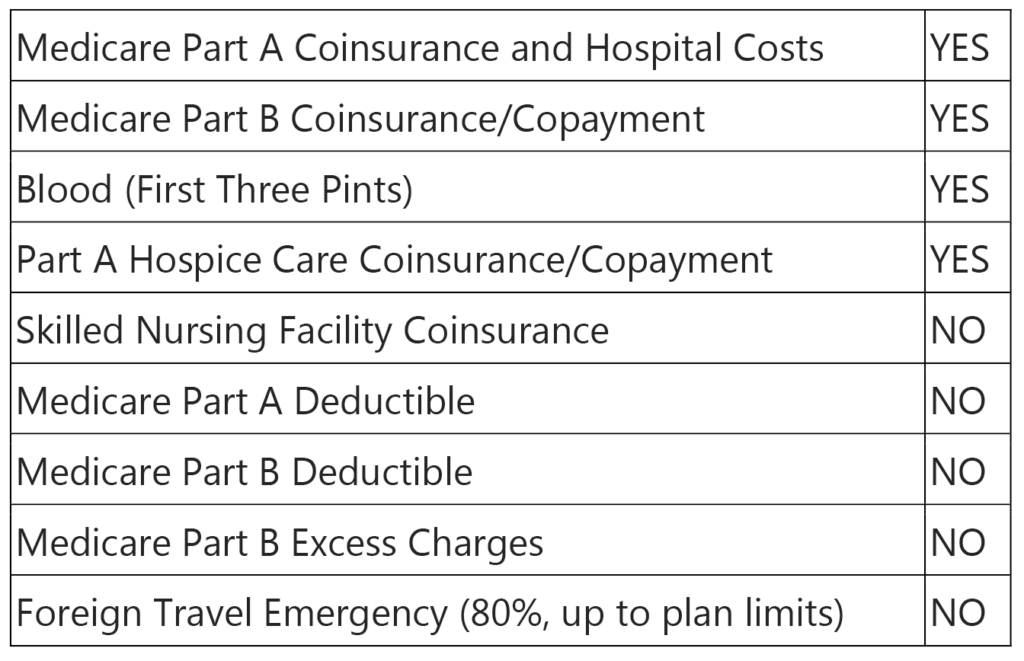

Medigap Plan A benefits include:

Medigap Plan A for People Under 65

Though Medicare is typically associated with retirees, it is also available to those with certain disabilities. If you receive Social Security benefits because of your insurance, you will be covered by Medicare as well. If you are under 65 and receive Medicare due to a disability, the only Medigap plan available to you is Plan A.

However, the price for Medigap Part A for people under 65 is usually much more expensive — often up to three times the cost. This is because those with disabilities often have higher healthcare costs than older people, and these increased costs are paid by you in the form of higher premiums.

So while Plan A is available to those with disabilities, you’ll probably be much better off enrolling in a Medicare Advantage plan. Medicare Advantage Plans are the same price for everyone who qualifies for coverage, regardless of age, sex, ZIP code, etc. When you turn 65, you can use your open enrollment period to switch to a supplement plan if that’s preferable.

What Is a Medigap Plan?

Medigap plans (also referred to as Medicare Supplement Insurance plans) are intended to help cover medical costs that aren’t covered by Medicare. Depending on your plan, some or all of the expenses you incur may be covered. However, the more coverage that’s included in your plan, the more your premiums will be.

In some cases, it’s much better to get a plan that offers fewer coverages. For example, if you don’t travel out of the country very often, you probably don’t need to pay for coverage for foreign travel emergencies. In addition to coverage, the premiums for your plan will be based on your age, sex, ZIP code, and a few other factors.

Note that Medicare Part A is NOT the same thing as Medigap Plan A! Medicare Part A is your original hospital coverage provided by the federal government. Medigap Plan A, on the other hand, is a supplemental insurance policy that covers some of the expenses that Medicare doesn’t.

When Can I Enroll in a Medigap Plan?

Technically speaking, you can enroll in a Medigap plan at any point after you have been enrolled in Medicare. However, your best option is to do so during your one-time Medigap Open Enrollment Period. This six-month period begins the month you turn 65 or older and are enrolled in Medicare Part B and ends on the last day of the 6th month.

During this one-time open enrollment period, insurance companies may not ask you health questions, and they cannot deny you coverage. In most cases, this open enrollment period only happens one time. Once it’s gone, it’s gone. The main exception is those who have Medigap Plan A coverage for their disabilities. They will have a second open enrollment period when they turn 65.

After your open enrollment period has ended, you can still apply for Medigap coverage. However, insurance companies can ask you questions regarding your health. In addition, they can deny you coverage or increase your premiums based on your answers. As such, it’s always better to buy a Medigap plan during the open enrollment period.

Note that the Medigap Open Enrollment period is not the same as Medicare Annual Open Enrollment. The Medicare Annual Open Enrollment period happens once per year in the fall and allows enrollees to change their Part D and/or Medicare Advantage Plan. Medigap Open Enrollment is a one-time event.

To learn more about all of your options, including enrolling in Medigap Plan A coverage, give us a call today at (678) 807-8414 or contact us online. We’re here to help Protect What’s Ahead!