Medigap Plan C is one of the most popular of the 10 plans available. It covers nearly everything possible by a Medigap plan, meaning nearly any costs that Medicare would pay a part of are covered by Plan C. As such, it is a great option for many people who need gap coverage. However, Medigap Plan C is one of the more expensive types of Medicare supplement insurance, so it may not be worth the cost to some people.

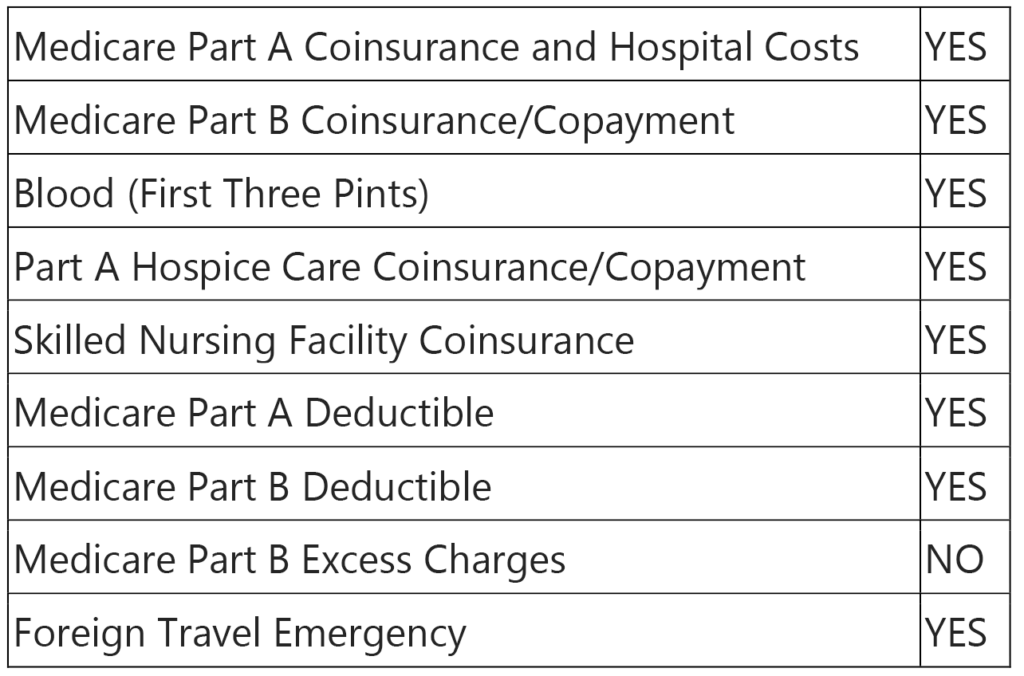

So what is Medigap Plan C, and why is it popular? This type of insurance covers:

As you can see, the only expenses not covered by Medigap Plan C are Medicare Part B excess charges. Healthcare providers may choose whether or not to participate in Medicare. If they choose to participate, they “accept Medicare assignment,” meaning they accept the amount of compensation provided by Medicare as full payment for services provided.

However, if a healthcare provider doesn’t participate in Medicare, they can charge up to 15 percent more than the amount allowed by Medicare if they so choose. This extra amount is called Medicare Part B excess charges. You are responsible for covering these excess charges, either out-of-pocket or through a Medigap plan. If your doctor accepts Medicare assignment, you don’t need to worry about having these excess charges covered by Medigap. As such, Plan C can be a great option.

How Much Does Medigap Plan C Cost?

As with every Medigap plan, there are a few different factors that will affect how much a Medigap Plan C policy costs. The most important factors are your age, sex, tobacco usage, and ZIP code. If you and your spouse or other dependent are both seeking Medigap coverage, some insurance providers will offer discounts for multiple policies in the same household.

No matter who you buy a Medigap Plan C policy from, the coverages provided are standardized. That means you can shop around to different insurance providers without worrying whether or not you will be covered. So, for instance, Medigap Plan C from Blue Cross Blue Shield may be less expensive than the same policy from United Healthcare, but will still offer all the same coverages.

An expert insurance broker here at MMIG can help you find the right company to buy a policy based on premiums, rates of annual premium increases, and the financial stability of the insurance company, among other factors.

When Am I Allowed to Enroll in Medigap Plan C?

Medigap Plan C, along with Plan F, is being phased out starting in 2020. If you will not be eligible to enroll in Medigap until 2020 or later, any plan that covers Medicare Part B deductibles will no longer be available to you. However, if you have either of these plans before 2020, you will be able to keep your coverage.

Once you have Medicare, you are allowed to enroll in a Medicare Supplement Insurance plan. However, there is an open enrollment period during which you should enroll. During this open enrollment period, insurance companies are not allowed to ask you medical questions, nor are they allowed to deny you coverage.

Except under very specific circumstances, this open enrollment period is a one-time event. This period lasts six months and begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. After your open enrollment period ends, you are still allowed to apply to enroll in Medigap. However, insurance companies are within their rights to ask you medical questions and deny you coverage (or increase your premiums).

This enrollment period is NOT the same as the Medicare Annual Open Enrollment period, which happens every fall. During the Medicare Annual Open Enrollment period, you can change your enrollment in Part D and/or your Medicare Advantage Plan. Because your Medigap open enrollment period is a one-time event that lasts only 6 months, it’s important to be prepared so make sure to speak with an expert insurance broker here at MMIG to find the right plan.

What Are Medigap Plans?

Medicare was created to help older Americans and those with disabilities get the medical treatment they need without worrying about the bulk of the costs. However, Medicare will only pay for part of your expenses, such as 80 percent of your Part B expenses. Shortly after Medicare was passed, private insurers began offering supplemental insurance plans.

These supplemental plans filled in the gaps left by Medicare (hence the name “Medigap”). Some plans, like Plan A and Plan B, offer minimal coverages but are also generally less expensive in terms of premiums. Others, like Plan C, cover virtually all of your expenses. The type of plan that’s best for you largely depends on your medical expenses and your budget.

Our expert insurance brokers can help you choose the right Medigap plan for your unique life situation. Give us a call at (678) 807-8414 or contact us online to review all your options for Protecting What’s Ahead.