Of the 10 available Medicare supplement options, Medigap Plan F is by far the most popular. This is because Plan F contains the most coverages out of any plan. If you enroll in Medigap Plan F, you will have virtually no out-of-pocket expenses (except a small copay on foreign emergency medical care). As such, this is the ideal Medigap plan for many senior Americans.

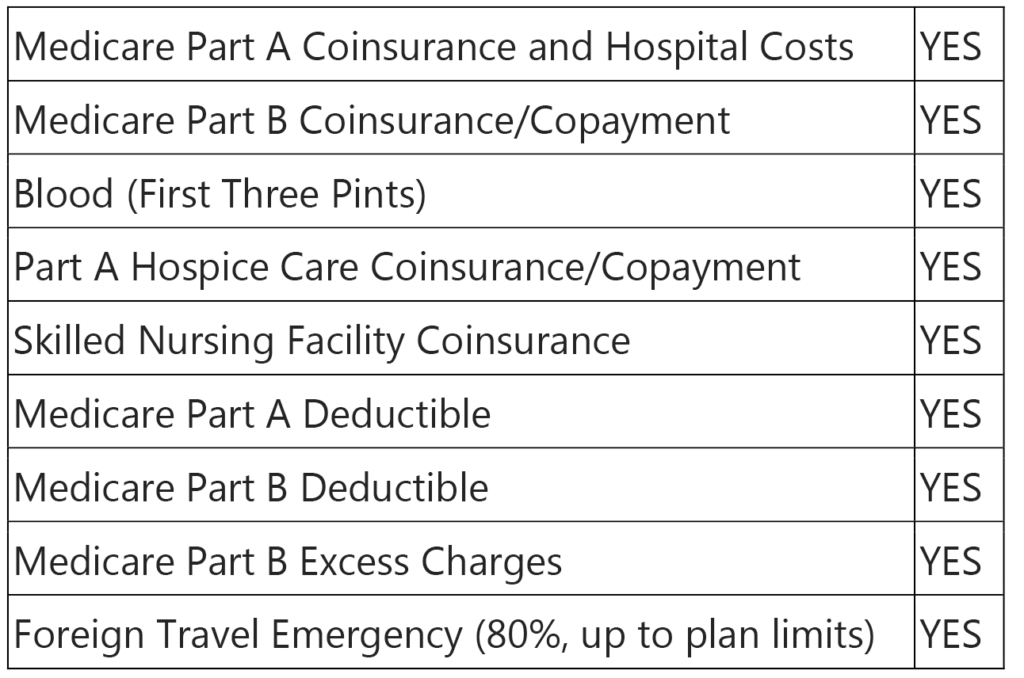

However, these plans can be prohibitively expensive. Depending on your medical needs, your financial stability and a wealth of other factors, Medigap Plan F in Georgia may not be the right insurance policy for you. So what is Medigap Plan F, and what does it cover? Coverages in this plan include:

Clearly, never having to pay out-of-pocket for medical expenses again is a great benefit to have. If you frequently visit the doctor or otherwise require a lot of medical assistance, Plan F is one of the best Medigap options available (besides maybe Plan G for some people).

How Much Does Medigap Plan F Cost?

Though Medigap Plan F is the most comprehensive plan, it is also the most expensive. However, how much it costs is impossible to tell without knowing your full story. The cost for every Medigap plan depends on your age, sex, tobacco usage, and ZIP code. In addition, you may get a discount if you and your spouse or other dependents in your household buy a Medigap plan from the same insurance company, that insurance company may give you a discount. A Medigap Plan F high deductible policy will be less expensive than a regular Plan F policy.

There are a lot of Medigap Plan F providers in Georgia and each one is required to provide the same standardized coverages. That means you’re free to shop around and find the insurance provider that’s right for you. Some insurance companies may offer a discount if you had health insurance with them before you qualified for Medicare, and you choose to buy a Medigap plan from them.

When you’re looking for a Medigap insurance provider, there are a few factors to consider. One, how expensive are their premiums? This will likely be the most important factor when you’re considering different providers. Two, how much have rates increased in the past few years? Rates tend to increase annually to keep up with inflation, but some companies increase their rates more than others. Finally, is the insurance company financially stable? If not, you may find yourself without coverage if the company goes under.

Figuring out what company to buy Medigap Plan F coverage can be complicated. Our expert insurance brokers can do the research for you to help you find the perfect plan that fits your needs and budget.

When Should I Enroll in Medigap Plan F?

Medigap Plan F, along with Plan C, is being phased out starting in 2020. If you will not be eligible to enroll in Medigap until 2020 or later, any plan that covers Medicare Part B deductibles will no longer be available to you. However, if you have either of these plans before 2020, you will be able to keep your coverage.

If you will be eligible for Medicare in 2019, your Medigap Open Enrollment period will begin the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. During this one-time six-month period, you can enroll in Medigap Plan F and insurance companies may not ask you questions about your medical history or deny you coverage.

Once this open enrollment period has passed, it will not come back. You can still apply for Medicare Supplement (Medigap) insurance, but after your Medigap Open Enrollment period, insurance companies can inquire about your medical history and deny you coverage based on your answers. They can also impose increased premiums if they do decide to offer you supplemental insurance.

Remember, if you are already enrolled in Plan F or C, you will be able to keep your coverage. These plans will simply be unavailable to newly-eligible insurance shoppers starting in 2020.

Why Do I Need a Medigap Plan?

For over 50 years, Medicare has covered the bulk of the medical costs for senior citizens. But this government insurance plan only covers part of the expenses. Medigap was created shortly after Medicare was introduced to bridge the cost gaps left behind by Medicare. Having these gaps covered by private insurance companies can provide relief for older Americans who may otherwise have to worry about copays, deductibles and other unexpected medical expenses.

There are 10 different Medigap plans, each offering different coverages. More expensive plans, like Plan G, offer almost full coverage for any medical expenses you may incur. Others, like Plan A, offer far fewer coverages but are generally much less expensive. Figuring out what Medigap plan is right for you can be complicated, but we’re here to help!

Give us a call at (678) 807-8414 or contact us today to speak with one of our expert insurance brokers. We’re here to Protect What’s Ahead by helping you find the right Medicare Supplement (Medigap) policy for you!