Medigap Plan L is a somewhat popular Medicare supplement plan that is available to Georgia residents. It’s similar to Plan K but offers slightly better benefits. Most gaps left by Medicare aren’t fully covered, but a majority portion of them are. As such, Medigap Plan L is generally less expensive than fully comprehensive plans like Plan G, but cost more than basic insurance policies like Plan A.

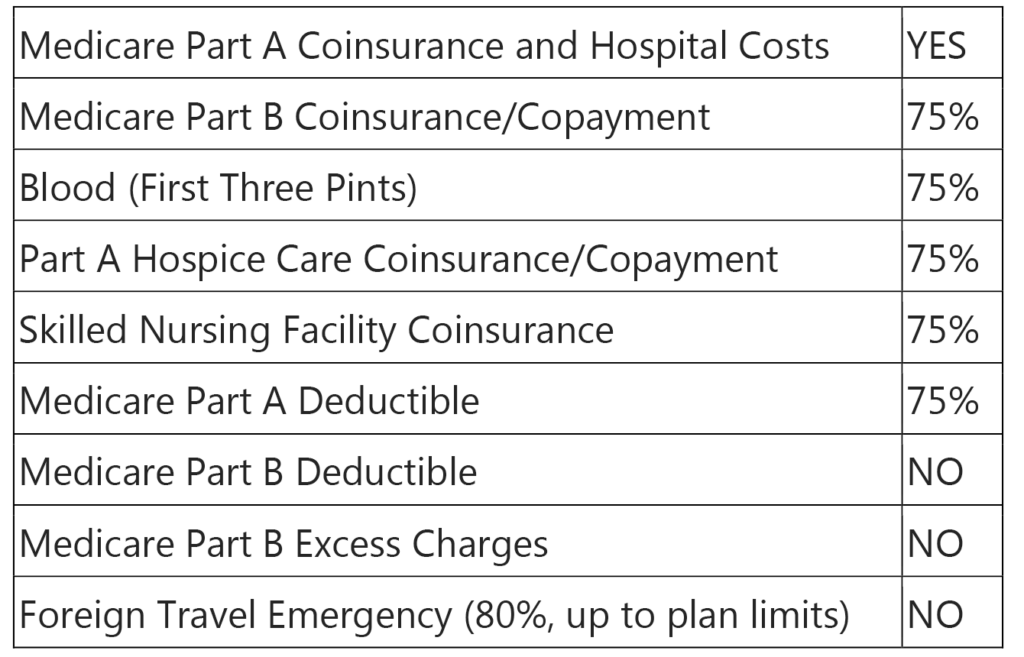

The benefits of Medigap Plan L include:

In addition to these benefits, there is a cap on annual out-of-pocket expenses under Plan L. In 2019, this cap is $2,780. Once you reach this cap on all of your Medicare-related medical expenses, everything else will be covered by Plan L. This can be highly beneficial for those who need a lot of medical treatments over the course of the year, but don’t want to pay high premiums for comprehensive coverage.

While Medigap Plan L does cover preventative care services under Medicare Part A, you are still responsible for paying for outpatient services and other expenses under Medicare Part B. However, the amount you pay toward your Part B deductible will count toward your out-of-pocket expenses cap for the year.

What Is a Medigap Plan?

When Medicare was passed over 50 years ago, it was intended to cover the majority portion of the medical costs incurred by older Americans and those with certain disabilities. Shortly after it was passed, private insurance companies began offering policies that bridged the gaps in Medicare. These Medigap policies were created to offer those on Medicare peace of mind that their medical expenses would be covered. In addition, Medicare supplements allow you to choose your own doctors and seek medical assistance anywhere in the country.

You are not required to buy a Medigap policy. However, doing so can be greatly beneficial, as you can see. With some policies, like Plan G, you don’t need to worry about how much visiting the doctor will cost in many cases. Others, like Plan L, allow you to more easily budget for a visit to the doctor or hospital by covering the bulk of the gap costs.

Choosing a Medigap plan can be complicated, and for some plans like K and L, only some providers will offer coverage. Our expert insurance brokers can help you find the right plan at the right cost, and also help you explore your other options like a Medicare Advantage plan.

When Should I Enroll in Medigap Plan L?

Your best option for enrolling in Medigap Plan L is during your Medigap Open Enrollment period. This period lasts six months and begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. During this six-month window, insurance providers may not inquire about your medical history, nor can they deny you coverage. However, once this six-month period is over, it’s gone for good in most cases.

After your Medigap Open Enrollment period, you can still apply to enroll in Medigap coverage. However, insurance providers can (and will) ask about your medical history. Based on your answers, they can increase premiums for Medicare supplemental coverage, or they can deny your policy altogether. If you want to ensure you get Medigap coverage and get it at the lowest price, be sure to enroll during your Medigap Open Enrollment period.

Note that Medigap Open Enrollment is different from Medicare Annual Open Enrollment. Medicare Annual Open Enrollment allows you to change your Medicare Part D and/or Medicare Advantage plans. These periods occur annually. Medigap Open Enrollment, on the other hand, occurs just once for most people and allows you to enroll in a Medigap Plan with no questions asked.

How Much Does Medigap Plan L Cost?

Determining the cost of Medigap Plan L on your behalf requires our experts to consider a few factors. The price of Medicare supplemental insurance largely depends on your age, sex, ZIP code, and tobacco usage. It also depends on when you enroll, as we mentioned previously. Some insurance providers will offer household discounts if you and your spouse (or other people legally part of your household) buy policies from the same provider.

As with Medigap Plan K, Plan L can be a bit more difficult to find than other more popular plans, like Plan G. The good news is, if you find multiple providers that offer Plan L at different prices, they are all required to offer the same standardized services. That means you’re free to shop around for the right plan that meets your needs and budget.

When you’re shopping for Medigap Plan L at different providers, consider first the premium, which is the amount you’ll be required to spend per month (or per year) for the insurance coverage. Then, consider how much the rates have increased over the past few years. Finally, make sure the company you’re buying from is financially stable.

While premiums are typically easy to find, the rate of increase and financial stability of a company can be much more difficult. But don’t worry: We’re here to help! Give us a call at (678) 807-8414 or contact us online to learn more about how our services can help you Protect What’s Ahead!