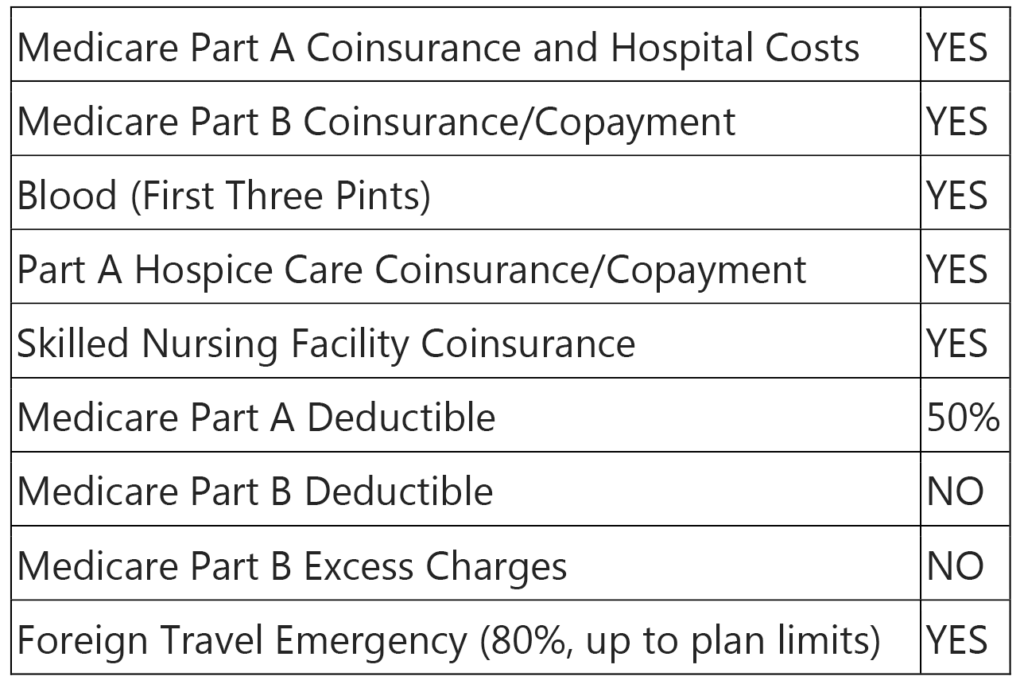

Medigap Plan M is one of the newest plans offered to those on Medicare. It was introduced in 2010 by the Medicare Modernization Act. It has many of the same benefits as comprehensive plans like Plan F, but with lower premiums. In exchange, you agree to pay half of your Medicare Part A deductible, as well as your full Medicare Part B deductible (as well as Part B excess charges).

The benefits included in Plan M include:

Medigap Plan M isn’t for everyone, but it can be highly beneficial for those who don’t find themselves in the hospital very often and can afford an occasional copay. It’s also beneficial for those whose doctor accepts Medicare. If a doctor doesn’t accept Medicare, they can charge up to 15 percent above the accepted Medicare cost for treatment. This is called Part B excess charges, and it is not covered by Medigap Plan M.

Plan M also covers a large part of your expenses if you need emergency medical treatment while you are traveling abroad. If you plan to travel in your retirement, having this type of coverage in your Medigap plan is important. Otherwise, you may be saddled with a large medical bill that could dampen your trip — or even prevent you from traveling as much as you would like.

Where to Buy Medigap Plan M

As we mentioned before, Plan M is a newer policy that not many people know about. In addition, the thought of cost-sharing instead of having comprehensive coverage isn’t appealing to as many people. As such, some Medicare supplemental insurance providers in Georgia simply don’t offer this type of Medigap plan.

When you do find a provider, they will base the price of your Medigap Plan M premium based on your age, sex, tobacco usage, and ZIP code. In addition, they may offer you a discount if someone else in your household holds a Medigap policy from the same company. Your premium may also be affected by whether you bought your policy during your open enrollment period (more on that in the next section).

Regardless of where you buy your Medigap Plan M coverage, the benefits will be standardized, meaning they will be the same for every company. That leaves you free to shop around and find the best deal on the right plan for you. One of the most important factors, when you’re shopping for a policy, is the premium, which can be generally easy to find.

However, there are two other factors to consider, which can be more difficult to find. The first is the rate of premium increases over the past few years, which can be an indicator of how much your premium will rise over the next few years. The second is the financial stability of the insurance company, which can affect your enrollment status altogether.

Our experts are here to help you find the right plan at the right price, from the right company. Get in touch with us today to learn about all of your insurance options, including non-Medigap options like Medicare Advantage.

When Should I Enroll in Medigap Plan M?

You can apply to enroll in Medigap at any time after you qualify for Medicare. However, the best time to enroll is during your Medigap Open Enrollment period. This period lasts six months and begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. During this Medigap Open Enrollment period, insurance providers cannot deny you coverage, and cannot ask you medical questions.

Once this six-month period ends, you can still apply for Medigap coverage. But insurance providers have the right to ask about your medical history and could deny you coverage based on your answers. If they do sell you a policy, the premiums may be much more expensive than they would’ve been during your Medigap Open Enrollment period.

Unlike Medicare Annual Open Enrollment, which happens every year, Medigap Open Enrollment happens just once, except under very specific circumstances. As such, it’s important to select your Medigap policy during this six-month period so you can lock in the best policy at the best priced premium.

What Is Medigap Insurance?

After you are enrolled in Medicare, you may be surprised to learn that not everything is covered by the government. You might have to pay for copays, deductibles, and other expenses. Medicare Supplemental Insurance (Medigap) bridges the gaps left by Medicare (which is where the term “Medigap” comes from).

As of 2019, there are 10 Medigap plans available to you. However, in 2020, Plan F and Plan C will be phased out. Some of these plans are fully comprehensive and cover nearly every Medicare-related cost, but are expensive. Others only offer a few benefits but are less expensive. Yet others, like Plan M, fall somewhere in the middle.

In the end, only you know what type of plan will work best for you. But if you aren’t sure what you’re looking for or where to find it, our expert insurance brokers can help. Call us at (678) 807-8414 or contact us online to learn more about Medigap, our services, and Protecting What’s Ahead.